Among all the changes occurring within the beverage-alcohol landscape, none is more important than the rise of women consumers. Women’s ascent as drinkers is literally historic: the majority of drinkers in the United States under the age of 25 are women, a shift that occurred for the first time ever five years ago. According to data from the National Survey on Drug Use and Health, rates of alcohol consumption among women outpaced those of men for the first time in American history in 2019. As of 2022, the survey found that more women than men report drinking alcohol at some point in their lives.

The shift came as a result of women’s economic and social empowerment. Long-term trends toward greater earning power, career advancement and educational attainment—all correlated with higher alcohol consumption and spending—have bolstered the percentage of women who drink alcohol, while percentages among men have dipped over the past 15 years. Combined with women’s role as the primary shopper in most households, it’s clear that women are the most important demographic of beverage-alcohol purchasers.

They wield both buying power and influence, said Bridget Brennan, CEO of the strategic advisory firm Female Factor and author of the books “Winning Her Business” and “Why She Buys.” But convenience stores haven’t fully captured this critical demographic yet.

“When I see the NACS data that shows 43% of convenience store shoppers are women, I flip that number in my mind and think: What an opportunity this is for the industry, because that means 57% are not [women]—yet,” Brennan said. “There is so much runway for convenience stores to grow with this crucial market of customers.”

Bullish On Beer

Females represent 40% of beer drinkers, and Diageo Beer Company sees growth opportunities for the category among its female customer base.

“Our data shows that the male/female alcohol consumption occasions are practically split by half (48% female, 51% male, 1% identifying as neither). When it comes to beer, it’s true that there is still an under-index among female consumers, but that has been changing over time,” said Ramona Giderof, vice president of chain accounts at Diageo Beer Company.

Specifically, Guinness continues to grow with female drinkers, adding +3% of additional female drinkers since 2018, she said.

When it comes to drinking preferences and occasions, “we believe female consumers are looking for a broader set of options across beverage alcohol,” as they tend to drink on occasions that surround a meal and connecting with others, whether they are friends, family, or both. “Therefore, they are motivated to choose drinks that are complementary to these occasions: easy to enjoy, appealing flavor or taste, and even appearance.”

The two drink types Giderof said c-stores can win female customers with? Zero sugar beverages and malt-based drinks. Women are twice as likely as men to consider zero sugar options, she said. “With nearly two-thirds of zero sugar flavored malt beverage dollars in c-stores being incremental to the category, offering zero sugar brands can be a win-win for both shoppers and retailers.”

A Critical Customer Base

Given the primacy of younger, legal-drinking-age (LDA) women as shoppers, stores’ beverage-alcohol offerings are central to attracting and retaining this customer demographic. Retailers across the board know that Gen Z represents the future. And that future—particularly for alcohol purchasers—is female. This is a marked shift from decades past, and the alcoholic beverage industry, in its many forms, is generally still playing catch-up. Historically, women haven’t been at the forefront of decision-making in the beer, wine and spirits space.

But the tide may, finally, be turning. Some of the most successful alcohol brands today—particularly in the ready-to-drink (RTD) segment—have seen their sales bolstered by women shoppers, and these companies are increasingly catering to the specific needs and preferences of women shoppers, while also recognizing that what’s appealing to them often has broad appeal for men, too. “When I’m creating campaigns, I’m trying to create the most value for someone who’s making that purchase decision,” said Kim Cuellar, director of trade marketing-chain accounts for BeatBox Beverages. Numerator data shows BeatBox convenience shoppers are 53% female, when combining purchases that women make alone with purchases that women make when shopping with men. “From that perspective, gender does matter to me because I want to provide the best experience and the best value to any customer, but in particular the beverage decision-maker, who, for BeatBox, does skew more female.”

In particular, Hispanic women are a core consumer base for BeatBox. Capturing a diverse consumer set will be critical for any beverage-alcohol brand or retailer given prevailing demographic trends. Census data shows the generation behind Gen Z, currently in their pre- and early teens, will be the first majority non-white generation born in the United States. Taking into account immigration as well as births, Gen Z will become majority non-white in 2026.

“Our data model shows that by 2025, there will be 10 million additional legal drinking age consumers who are multicultural, and 33 million by 2035. So, 9 in 10 new LDA+ drinkers in the United States will come from multicultural communities,” said Ramona Giderof, vice president of chain accounts at Diageo Beer Company.

“As Gen Z continues to diversify rapidly in terms of race and ethnicity, the landscape of beverage sales is shifting. This demographic shift has significant implications for convenience stores in terms of product mix, shopper behavior and more,” said Taylor Newberry, regional account manager southwest for Pabst Brewing Company. “By 2025, an estimated 62% of the U.S. population will be millennials or younger, reflecting a more diverse and multiracial society than ever before.”

There is no way to cater to the next wave of c-store customers and beverage-alcohol consumers without putting women—and especially nonwhite women—at the forefront of decisions about the in-store experience.

Understand The Modern Woman …

So, what do women want? More importantly, you should ask: Who is the woman shopping for alcohol in a c-store?

That typical shopper may be younger and more affluent than the woman shopper of last decade. As convenience stores prove more resilient than other forms of retail, the stores’ prioritization of well-prepared food and premium coffee have made c-stores more attractive to women.

Harvey Collins, Southeast adult beverage category manager for Circle K, said these shoppers are top-of-mind when she’s making decisions about her stores’ aisles. One of Circle K’s core shopper demographics is dubbed the “Working Wonder Woman.” She’s a woman with a job and maybe a family who juggles several responsibilities and makes purchasing decisions for her household. It’s a role Collins herself can relate to.

“I’m a female, so in everything that I do, I think about what my needs are and what I like to see as a shopper. I basically take my desires and needs and strategically come up with ways to make the category more attractive to our female customers who shop our stores each and every day,” Collins said.

The pandemic also recategorized c-stores as a beverage-alcohol destination for the segment of shoppers who may have previously shopped at liquor stores. The desire to consolidate shopping trips and spend less time inside stores seems to have encouraged new, affluent customers to buy wine at their local c-stores, said Michelle Abdollah, category manager for alcoholic beverages at ExtraMile Convenience Stores. Given that Gallup polling shows women are three times as likely as men to consume wine as their most frequent type of alcohol, many of these new, wine-seeking shoppers are women.

The majority of drinkers in the United States under the age of 25 are women.

“More wine drinkers are shifting to look at the c-store channel and that means we do have to have a destination for wine to attract those customers,” Abdollah said.

Diageo’s Giderof also said c-stores can capitalize on being a one-stop-shop for alcohol consumers by pairing alcoholic beverages with food for meal deals.

“Promoting meal bundles online and within retailer loyalty apps can both drive traffic and overall basket rings with consumers on their way home from work,” she explained. “Our household data shows that shoppers whose baskets contain both beer and prepared meals spend over $40 per trip in the c-store channel—that’s over $25 more than shoppers that purchase neither category.”

Whatever their preferred beverage, it’s imperative that these shoppers easily find the product mix, price points and flavors they’re looking for.

Perhaps just as important is what modern women don’t want to see: outdated, reductive advertising. Brennan suggests stores take a critical look at their current displays to make sure women are not only included in visuals, but that they’re active participants in the action. Avoid depicting women only in family situations, she said, as women today play many roles in their workplaces and communities.

“We make sure to show our products in authentically diverse and inclusive occasions. From food, to sports watching, to enjoying a drink at their favorite bars, we ensure that our female drinkers are equally part of our brand stories,” said Giderof.

And finally, unless a store or product is explicitly raising money for breast cancer research, Brennan cautioned against relying on pink to signal products geared toward women. “Pink is not a strategy,” Brennan said. “Women play many roles in life and understanding these roles opens up more opportunities to connect [with them as customers].”

… And What She Wants

Women are not monolithic in their alcohol choices. Broadly, consumers are drinking more across bev-alc categories than ever before, selecting beer on one occasion, wine the next and perhaps a malt-based RTD cocktail after that.

Circana data from 2023 shows 26% of drinkers say they consume beer, wine and spirits, while the percentage of drinkers who choose exclusively one category fell between 2019 and 2023. As drinkers move across alcohol categories, flavor and format have become increasingly important purchase motivators. And for women, flavor and format converge in unique ways.

Social Media Buzz

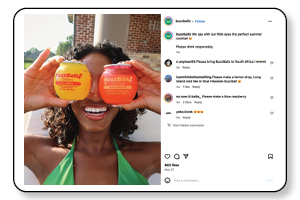

Southern Champion’s single-serve BuzzBallz product has a 57% female buyer ratio. The woman-owned alcohol brand said it has a broad consumer base, with a diverse range of ethnicities and ages, including strong representation from the Black and Latino communities and females 21 to 54 years old. The brand mostly targets Gen Z and Millennial females for its products.

“We see most of our audience coming from these generations. This can be attributed to Gen Z and Millennials’ fast-paced lifestyles as they often use the convenience channel as a stock up trip, a very different shopper compared to more mature shoppers of today,” said Tia Wines, director of marketing for Southern Champion. “They are looking for cost-conscious beverage options and enjoy trying new things.”

BuzzBallz packaging and advertising strategy puts women at the center of its messaging, starting by prominently promoting its women-owned status on its containers and displays.

“In our marketing strategies, primarily with organic social content, we often cater to our female audience with specific trend-based content as well as female-oriented thematic photoshoots. We want to promote the fact that BuzzBallz are able to be enjoyed by anyone for any event,” said Wines. “We see a lot of creators on Instagram that use our BuzzBallz for floral arrangements or bedazzling projects. Two things about our products that often connect with our female customers are bright colors and fruity flavors. The bright colors make our product perfect for coordinating outfits and taking photos with.”

“There’s a lot of blurriness within alcohol right now, so we have seen new segments develop—malt-based RTDs and wine-based RTDs like BeatBox and BuzzBallz exploded—and a lot of those drinkers tend to skew females as well,” said Abdollah. She says it’s a combination of convenient, single-serve packaging and bold flavor that has made these products a hit with women.

Efficiency and flavor are important to men, too, but experts say women in particular gravitate toward smaller package sizes than men do. The reasons are varied: Women may not want to carry large 30-packs of beer, they might simply want to consume less liquid overall or they’re interested in a single-serve package that provides a low-cost trial. Observing that women shoppers most frequently purchased alcohol packaged in sizes at or below 187 millimeter bottles or 16 ounce cans, Circle K has been introducing single-serve alcohol into its queue lines, driving impulse buys and sales growth.

Collins says when women come into c-stores with their families or to use the restroom, they don’t often have time to peruse the entire store, and they’re unlikely to explore the beer cave. Promotional displays of brands that over-index among women should therefore be in high-traffic areas that are within the line of sight of the entrance and register.

“I am strategic with placement of core items females typically shop for,” Collins says. “If in a door, will the door be in the line of sight for the female customer as she makes her trip to the restroom or foodservice area?”

Within legal drinking-age Gen Z, there’s that important layer of the female Gen Z shopper.”

Suppliers agreed that innovative and strategically placed displays can drive sales volume. Southern Champion’s BuzzBallz uses its “novelty spherical shape that is cute and unique,” as well as “bright colors and fun, trendy messaging,” in its in-store displays to “catch attention the second someone enters the store,” explained Tia Wines, director of marketing at Southern Champion.

There may still be a major area, though, where many c-stores are missing an opportunity to connect with women shoppers: immediate refreshment. Women are twice as likely as men to make an alcohol purchase from a warm display versus a cold box, likely because they avoid the beer cave. But there is also a rise in immediate consumption: NACS data shows 83% of items purchased at a c-store are consumed within an hour. Stores would be wise to offer women cold adult beverages in cooler doors, offering the convenience of a pre-chilled item without a trip inside the beer cave.

“C-store visits are usually driven by convenience or occasion, so single-serve, full bodied and ready-to-drink cocktails fill the inherent gap c-store customers are looking to fix with premium flavor, strength and convenience,” said Wines.

These subtle insights can unlock huge opportunities over time. Focusing on the identities, lifestyles and preferences of women shoppers is—given current demographic trends—table stakes for today’s c-store operators.

“Most of the time when we hear something about c-stores looking for more consumers, it’s always focused around Gen Z, Gen Z, Gen Z. But within legal drinking-age Gen Z, there’s that important layer of the female Gen Z shopper,” Beatbox’s Cuellar said. “They’re coming into this new phase of independence as a key decision-maker.”