Candy and salty snacks continue to dominate c-store inside sales, according to Tim Young, category marketing manager, Newcomb Oil.

“Collectively they both put up huge numbers,” said Young. “Both categories are in the top 10 in sales and in gross profit dollars, with candy delivering the third-highest gross margin percentage of all the merchandise categories behind ice and health and beauty care. Both candy and salty snacks drive trips, and they help build baskets.”

Candy and snacks also respond well to promotional offers, according to Young, because they are impulse driven, and they are known as an expandable consumption, which is consumption built on demand.

Here’s how these two categories fared in 2021.

CANDY BUILDS BASKETS

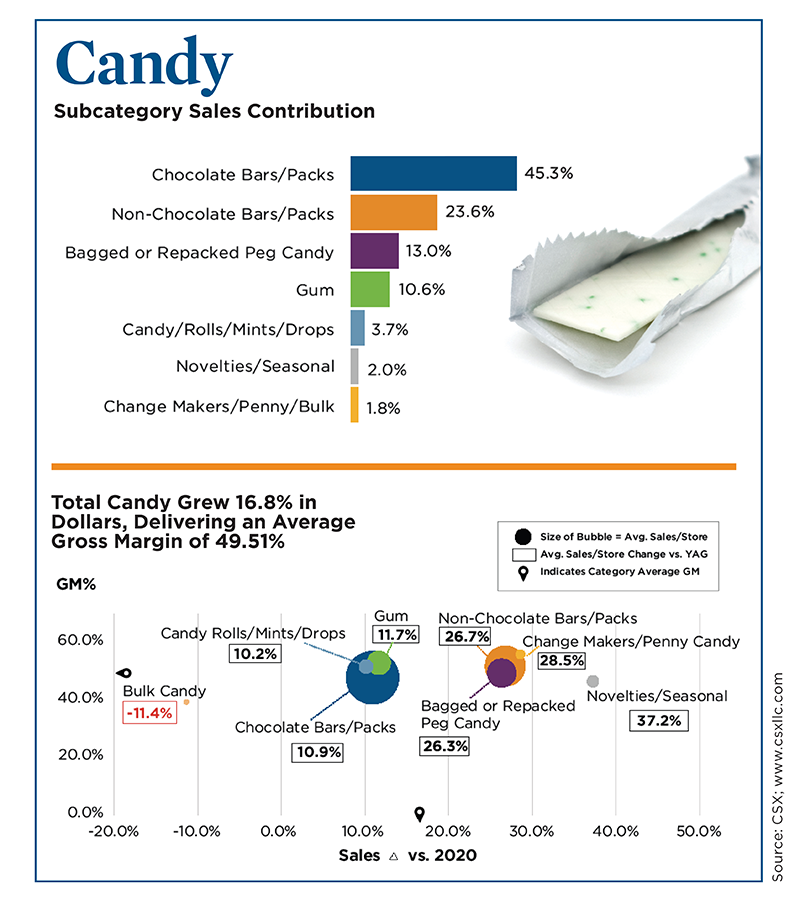

Candy represented 3.26% of in-store sales at convenience stores and 4.66% of in-store gross margin contribution in 2021. The total candy category grew 16.8% in dollar sales last year over 2020 and delivered an average gross margin of 49.51%.

Candy sales definitely helped sweeten some of the challenges in 2021 by making ordinary moments more special.

Looking closer into the candy category, chocolate bars and packs continue to drive the category, said Young, commanding more than 45% of category dollars. However, the subcategory only posted sales gains of 10.9% year over year, lagging the category average, but the subcategory delivers an impressive gross margin of 47.8%.

The non-chocolate subcategory, while only 23.6% of the candy category, showed strong growth in 2021—up 26.7% in sales over 2020. Another small subcategory, seasonal candy, also posted impressive sales growth of 37.2% year over year.

Sales of gum and candy/rolls/mints/drops recovered last year from a sales decline in 2020 due to the loss of commuter traffic during the COVID-19 pandemic—the subcategories were up 11.7% and 10.2% year over year, respectively. The change makers/penny candy subcategory also saw sales gains last year of 28.5% over 2020 results; however, bulk candy is beginning to lose relevance with c-store shoppers—down 11.4% year over year.

“Candy sales definitely helped sweeten some of the challenges in 2021 by making ordinary moments more special,” said Young. “I’m firmly convinced that convenience stores are just concession stands for adults.”

“Candy sales definitely helped sweeten some of the challenges in 2021 by making ordinary moments more special,” said Young. “I’m firmly convinced that convenience stores are just concession stands for adults.”

Young said 2021 saw innovations in the category, including new packaging, mixed textures and better-for-you options. “Innovation is very important to this category. It brings new shoppers, it builds bigger baskets, and it creates excitement,” said Young.

Merchandising candy should be a key priority for the category this year, said Young.

Dayparts matter, and it’s important to create an experience when customers visit a c-store.

“We’ve come a long way over the years,” said Young. “From the days of Cokes and smokes to now, we’re truly a food destination that sells fuel, but also, we’re in the entertainment business, and we are creating an experience.”

He added that not all days are equal and not all hours within a day are equal, so retailers should look at the relevant dayparts and add programming that speaks to a given day. Retailers should also make sure that digital and forecourt marketing connects with in-store offers and take steps to eliminate the clutter in stores overall— make the product as easy as possible to find, he advised.

Assortment should also be priority in 2022, said Young. Limited-time offers drive excitement, and retailers should consider the digital and loyalty shelf for added offerings. Better-for-you candy and portion control options are a major trend right now, so satisfy shoppers seeking these products by calling them out in store.

“Don’t forget about pricing and promotion on candy,” said Young. “Cross-category promotions and pricing, like coffee and gum/mints or coffee and a candy bar, drive impulse.” He added that bundled pricing and club offers build bigger baskets.

“Do a foodservice bundle where the customer can choose between a salty or sweet option as a top off,” said Young.

Do a foodservice bundle where the customer can choose between a salty or sweet option as a top off.

SALTY SNACKS RECOVER

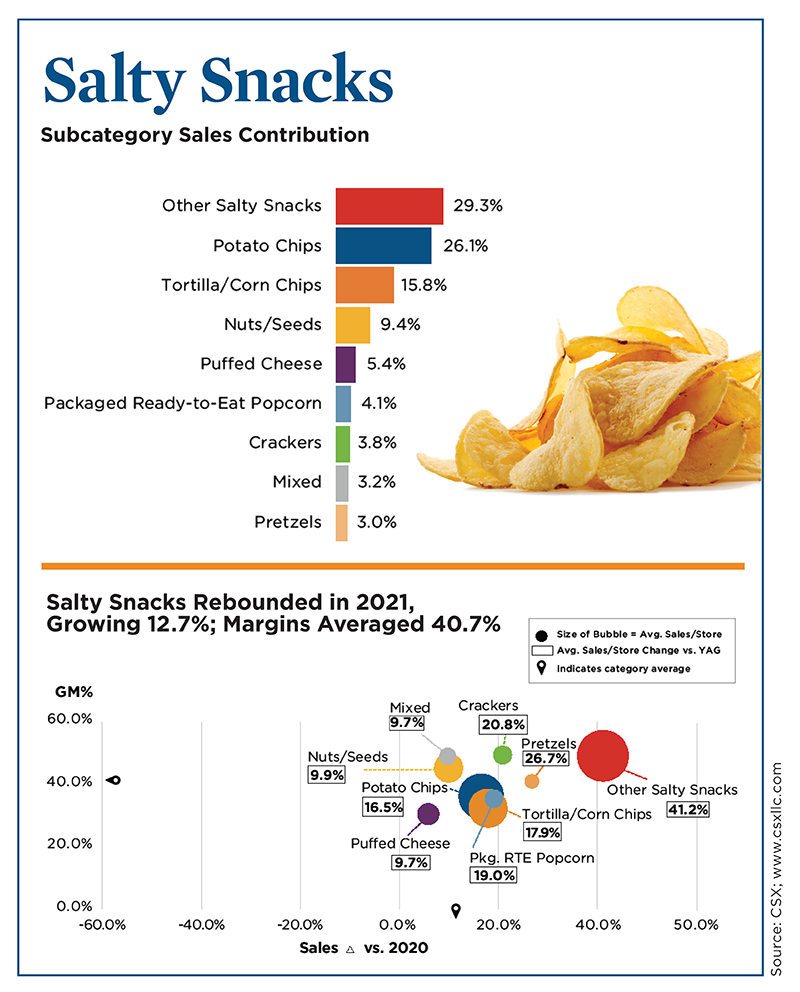

Salty snacks represented 4.22% of in-store sales and 4.93% of in-store gross margin contribution in 2021. The category rebounded in 2021, growing 12.7% year over year, and gross margins averaged 40.7%.

The other salty snacks subcategory (i.e., puffed vegetables, extruded onion rings, pork rinds) continued to be the largest segment of salty snacks at 29.3% of the category. It also was a heavy hitter—up 41.2% in sales year over year. The next largest subcategory was potato chips, which made up 26.1% of the salty snacks category and grew 16.5% over 2020. Both segments comprised more than 55% of category dollars.

Tortilla chips, along with nuts/seeds, together comprised a quarter of category sales, with the remaining sales delivered by puffed cheese, ready-to-eat popcorn, crackers, pretzels and mixed snacks.

“Salty snacks continue to evolve to meet diverse needs of shoppers across all lifestyles and groups,” said Young. Suppliers have done a great job going bold with flavors, such as Paqui’s chips and its Haunted Ghost Pepper flavor, as well as potato chips that offer unique flavors like cheeseburger and Korean street tacos.

“As snacking versus meals becomes a more routine diet for many, the appeal of products that pack a lot of protein is also important,” said Young. “We’ve seen the explosion of alternative snacks bring growth to flavored meat sticks and jerky, but we’re also seeing more routine chips promote the satiety that comes with added protein.”

Also, less-traditional key ingredients found their way into salty snacks, such as chickpeas and kale, and some plant-based entrants accurately mimicked long-standing category flavors, such as Pig-Out’s plant-based pork rinds.

Trends that will affect salty snacks this year include supply chain challenges, pricing and merchandising. “No doubt we have seen supply chain challenges,” said Young. “We’re seeing this in all trades, so find out how strong your vendor pipeline is because this will impact your assortment and promotional activity.”

Pricing becomes a challenge because retailers have margin number expectations, but utilizing loyalty programs can help offset some pricing issues, according to Young.

When it comes to merchandising, it’s all about dollars per square inch, Young said, and he encourages retailers to think differently about merchandising and promotions. “Don’t be afraid to test and learn with ideas,” he said. “Get outside of your bubble and visit the competition.”