The summer driving season is here and record-breaking gasoline prices in 2022 are still lingering in American motorists’ minds. What are some of the trends that will influence prices for the summer driving season as well as the remainder of 2023? For starters, 2023 is not 2022.

“Last year the message was much different. The world was coming to an end; Russian oil production was going to zero,” said Denton Cinquegrana, chief oil analyst at Oil Price Information Service (OPIS), a Dow Jones Company. “We’re not going to have enough gasoline, not enough diesel—which for diesel probably came a little bit too close for comfort. You saw all the forecasts of $200 or $250 oil. But none of that happened. Cooler heads prevailed.”

Cinquegrana began his 2023 SOI Summit presentation focused on crude oil. He noted that at the beginning of the year, predictions had crude reaching $100 or more on oil demand driven by China lifting its zero-COVID policies. All the growth in demand was going to be east of the Suez. The U.S. and Europe were going to be flat or maybe a little bit lower. And, headwinds remain for the market to contend with, such as lagging U.S. oil production.

“[Producers] are back to March 2020 levels, just under 13 million barrels a day. But don’t expect the cavalry to come. There are bankers, there are shareholders, there are bond holders, saying you guys have crashed the market three times. We want some return on investment. And then OPEC+ had a surprise—a 1.6 million barrel a day cut.”

If there is an international emergency involving the United States, the lack of a robust SPR could impact prices.

He noted there are two prevailing thoughts on what drove the cut. The first is that OPEC may have seen demand from China coming in light. And the second, perhaps a bit more compelling, is a response to the Biden administration’s draw-down of the Strategic Petroleum Reserve (SPR) before the midterm elections.

“The Biden administration said it would buy oil to refill the Strategic Petroleum Reserve when the prices hit a band of $68 to $72. We got down there with the mini banking crisis that we saw in mid-March. But prices hit $64 or so and the energy secretary said, we’re not going to fill in 2023. And the market was anticipating that $70 SPR buy as setting a floor for the market. So OPEC came in and said, well, if you’re not going to set a floor, we will.”

He believes that $100 per barrel is still possible, but then so is $70, or even less.

The case for $100 has Chinese demand overwhelming current supply or a significant production disruption from the “fragile” countries—Nigeria, Iraq, Libya, etc. Investors are getting back into the oil market, which will help with current volatility but could drive up the price up if it becomes a stampede. And, if there is an international emergency involving the United States, the lack of a robust SPR could impact prices.

On the other hand, increasing international production and recessionary fears push the $70 or less model.

Russia’s still producing quite a bit of oil and has buyers such as China and India. Venezuelan production is returning. The dollar has been depressed, which drives prices up, but a recovery could drive oil prices downward. Of course, an economic downturn would impact demand.

Refined Products

Cinquegrana noted that more refining capacity is coming online, not just in the United States but globally. However, there was still some of the traditional production lag found heading into the summer driving season.

“We’re still running well below where we might normally be with gasoline and distillate inventories. Gasoline’s [down] around 15 million barrels a day. But all that deficit is in the Midwest and on the East Coast, and that makes sense considering those are the two markets that are making the transition from winter gasoline to summer gasoline. I think they’ll start to catch up,” Cinquegrana said.

We’re still running well below where we might normally be with gasoline and distillate inventories.

He noted that a hurricane could create real problems this summer and into the winter. Also, refineries transitioning to make biofuels have an impact. “The amount of hydrogen you use to make a product like renewable diesel compared to petroleum-based diesel is like four times greater,” said Cinquegrana. “So, you’re doing less with more. If you transition a refinery that makes 100,000 thousand barrels per day of renewable diesel, it’s probably only about 25,000 to 30,000 barrels per day.”

Distillate inventories are still low, also at about 15 million barrels, but the mild winter on the East Coast helped support inventories through reduced heating oil consumption.

In 2022 there was approximately $0.40 between May and June ULSD futures and about $0.60 between March and April. That is when backwardation and impacted inventory builds. “If I’m moving barrels to terminal storage, why am I going to hold onto inventories when the next day it can be worth $0.40 less? As a result, you didn’t have the opportunity for distillate inventories to build back up.”

Cinquegrana said that the steep backwardation is dissipating in 2023.

Summer Gasoline Prices

Cinquegrana noted that gasoline demand this summer could be higher than last year because prices are not going to approach $5 a gallon nationally. “I don’t see a scenario for $5 gasoline this summer,” he said. “I even think that we’re probably close to a peak. The national average right now [April 2023] is around $3.70, and even if we do get to $4 a gallon, I think it will be short-lived.”

Cinquegrana noted that gasoline demand this summer could be higher than last year because prices are not going to approach $5 a gallon nationally. “I don’t see a scenario for $5 gasoline this summer,” he said. “I even think that we’re probably close to a peak. The national average right now [April 2023] is around $3.70, and even if we do get to $4 a gallon, I think it will be short-lived.”

He noted that EIA data suggests 2023 will not be a demand growth year. The distillate demand calculations are already showing recessionary levels. That will allow distillate inventories to build up as well. “I don’t see demand getting back to pre-pandemic levels for a variety of reasons. And then market volatility should continue and that’ll make [rack to retail] margins feast or famine.”

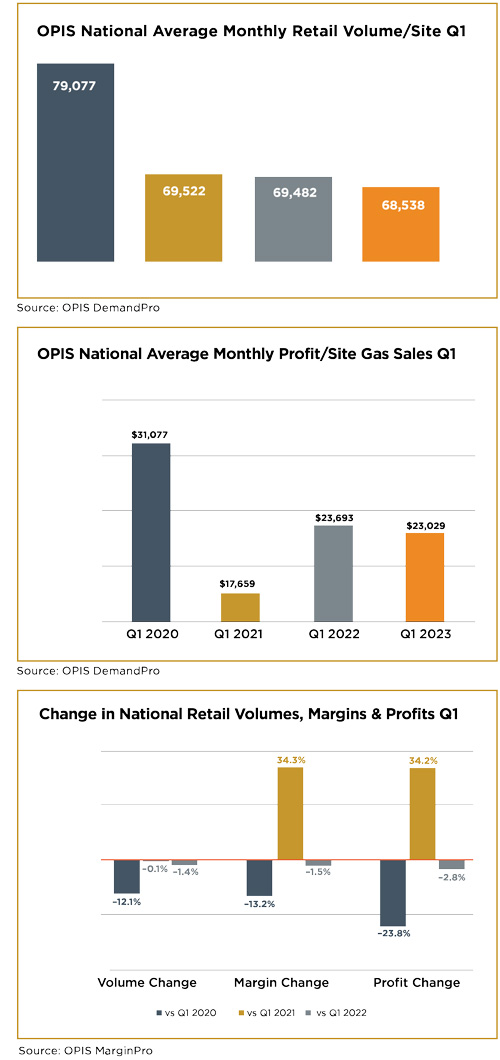

Margins in 2022 ranged from over $0.60 to under $0.10, driven by significant price volatility. Volatility is so far reduced in 2023 but is still sufficient to where the unusually high margins might be expected to continue.

Several factors will be impacting demand in 2023, and most certainly for years to come.

Vehicle efficiency has been improving for internal combustion engines for decades, and the pressure is only getting ramped up. Cinquegrana noted that while there is a big push for EVs, CAFE standards are going to push the gallons out of the market short-term.

“Vehicle efficiency is only going to get better—some 49 miles per gallon by 2026 for passenger cars and light duty trucks. Yes, EVs are coming, but they’re still only about 6% of car sales in 2022 and 1% of the fleet,” Cinquegrana said. He shared an estimate from Coltura that the 2.24 million EVs on the road replaced just a half a percent of gasoline consumption.

Cultural changes with work from home after the pandemic are also coming into play. He noted office rates are about 50% of capacity in the United States. An informal analysis suggests this trend has potentially sliced off 343,000 barrels a day of gasoline demand, though hybrid work models might only see a reduction of between 115,000 to 170,000 barrels a day.