Any slight gains the beer category reaped in convenience stores in 2023 appear to have been reversed. Still, marketers emphasize that the category remains a vitally important one for the channel as it’s a key in-store revenue and margin contributor and huge traffic driver.

“Coming off the back of four years of growth, c-stores were actually down 1% in 2024 for beer,” despite strong performances by imported brews and continued growth for flavored products, said Chris Risk, senior manager of customer solutions at Molson Coors Beverage Co.

Greg Merlo, vice president, category leadership, at Anheuser-Busch InBev (AB InBev), noted that even with the lackluster performance, dollar sales for beer in c-stores were nearly twice that of energy drinks last year. “Key performance drivers included accessibility, as beer provides shoppers with affordable entry points within beverage alcohol across price tiers and styles,” he said.

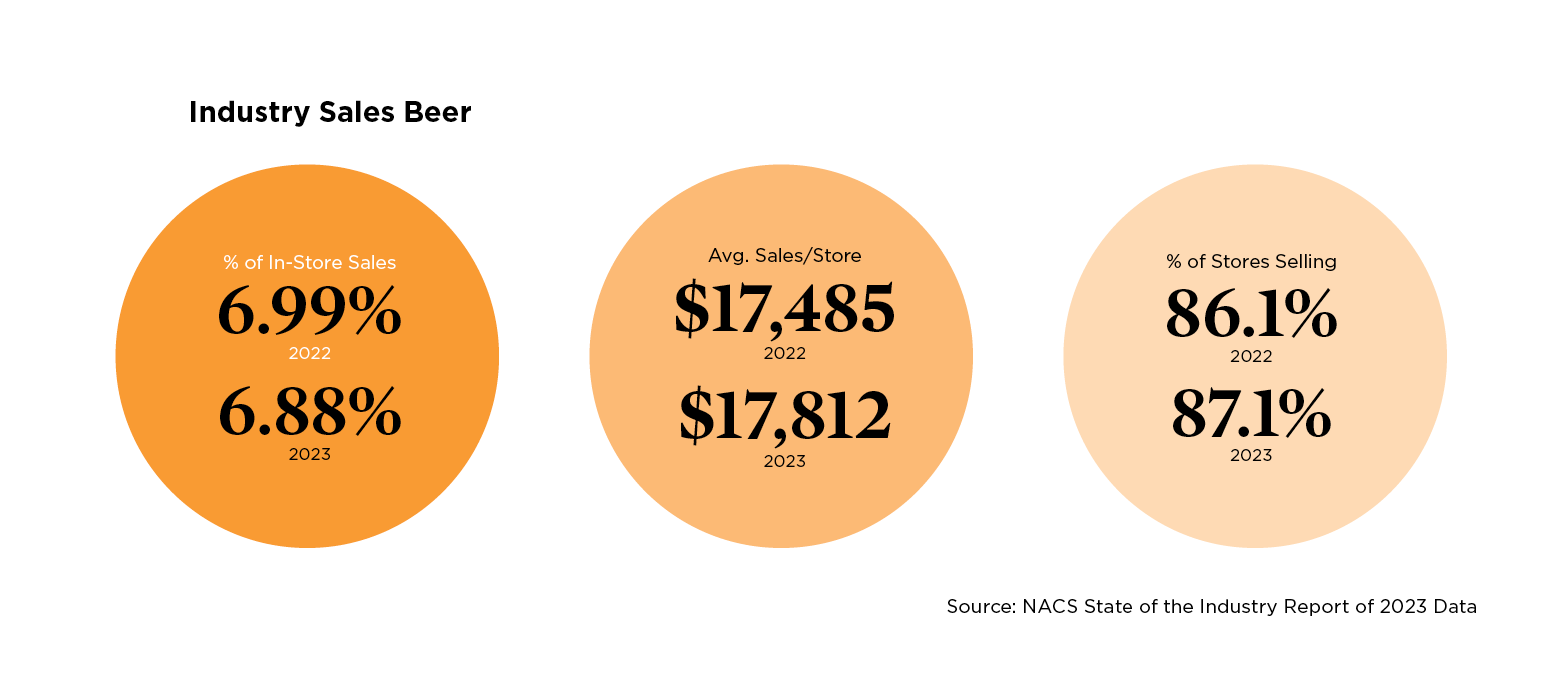

According to the NACS State of the Industry (SOI) Report® of 2023 Data, average beer sales per store, per month increased to $17,812, with an average gross profit of $3,683. The category accounts for just under 7% of all in-store sales. For the first half of 2024, beer sales per store, per month largely tracked that of the prior three years, but by the third quarter, sales began to dip lower, NACS CSX data shows. Emma Tainter, research analyst at NACS, said that while beer is “a consistent and steady category for c-stores,” retailers should be aware of emerging trends that may hamper growth for all alcoholic beverages going forward, such as reduced consumption by Gen Z consumers.

Healthy Subcategories

While performances for major subcategories such as premium and popular beers fell lower in 2023, several subsegments enjoyed growth in c-stores, namely flavored malt beverages, imports, and non-alcoholic brews. According to SOI data, flavored malts jumped into the No. 2 position among beer subcategories in 2023 (behind premiums) as average store sales per month increased to $2,805. Imports, meanwhile, led by fast-growing brands like Modelo Especial, moved into the No. 3 spot, with average monthly sales of $2,696.

Those trends largely continued into 2024. “Consumers continue to seek flavor variety and indulgence with beer,” explained Risk. “The biggest themes in flavor are hard teas, with sales of over $1 billion in c-stores last year, a 14% increase, and chelada flavors, now worth $761 million a year.” Nick Rogers, retail merchandising manager at The Markets at Tiger Mart, with 10 stores in Virginia, agrees that hard teas continue to be popular. While White Claw is the chain’s top-selling flavored malt beverage, “we sell a ton of Twisted Tea, in both 12-packs and 6-packs,” the retailer said.

“If it’s nice out, everyone wants beer. If it’s not nice out, they don’t want it.”

The still tiny non-alcoholic beer subcategory also bears watching. Driven by consumer efforts at healthier lifestyles and a wave of new products from major beer marketers and craft brewers, non-alcoholic beers are gaining in sales and awareness. While overall beer sales per store, per month have tracked fairly consistently for the last four years, non-alcoholic beer sales have risen each year at a healthy clip. In July 2024, the subcategory reached average per-store sales of $80.

Category Workhorse

Singles remain the category workhorse in the convenience channel, growing at a 10% compound annual growth rate over the last five years, according to AB InBev. “Singles deliver 33% of dollar sales while driving 52% of beer trips and over 60% of units,” reported Merlo. Moreover, singles packages are a huge transaction and traffic driver for c-stores, added Risk, with around seven million beer singles sold each day in the c-store channel last year.

At the Tiger Mart outlets, the strength of singles stands out as the biggest beer trend, Rogers noted, while large packs are experiencing a downturn. With recent beer price hikes, “consumers are leaning into singles for daily consumption” and forgoing purchases of larger beer packs, the retailer explained. And within the singles segment, beers with high ABV levels are performing best, as consumers seek “more bang for their buck,” Rogers said. In fact, thanks to the margin growth on singles, beer sales at The Markets at Tiger Mart increased last year, the retailer reported, and he expects that situation to continue in 2025.

Beer singles have been performing so well at the chain that Tiger Mart is actively working to devote more space to the packages in an effort to boost days of supply, including the removal of some larger pack sizes to accommodate. Most of the stores dedicate two cooler doors to singles, “but we’re trying to get to three,” Rogers noted. To promote singles sales, the chain offers two-for deals on the packages, which helps “drive unit growth,” he said.

Both Risk and Merlo encourage c-store operators to carve out ample space for beer singles. “Best-in-class retailers have at least one-third of beer cooler space dedicated to singles to be able to have the inventory on the fastest-moving SKUs, expanded assortment on flavors like hard tea and spiked lemonades and the core domestic brands,” the Molson Coors executive said. While singles were just behind 12-packs in dollar value last year, they’re expected to overtake the larger package this year, Risk reported. “Retailers should ensure they have adequate space dedicated to singles, executing multibuys, and a clear pricing strategy, along with ice bins in high-traffic areas,” he advised.

Seasonal Surge

Interestingly, some convenience retailers report that beer multipacks are more prominent in their stores than singles. “Thirty-packs are our big seller, as we promote them at the state minimum price,” said Doug Smith, co-owner of Mt. Top Convenience in Thomas, West Virginia. Similarly, at Millwood Market in Millwood, New York, multipacks of brands like Coors Light, Budweiser, Corona Extra and Modelo Especial outsell singles, according to general manager Frank Cala.

He noted that sales of the packages can be somewhat weather contingent. “If it’s nice out, everyone wants beer,” the retailer said. “If it’s not nice out, they don’t want it.”

With sales of some $7.5 billion in c-stores last year, 12-packs remained the No. 1 pack size on a dollar basis, Risk noted. At an average price of $16.88, 12-packs “offer high velocity and drive revenue through the register,” the beer executive said. He recommends that retailers position 12-packs mid-height in the cooler with “clear price signage,” with 18-packs in the well. For c-stores with beer caves, stacks of 12-, 18-, 24-, and 30-packs help retailers prepare for the “weekend stock-up trip,” Risk said.

Executives at Molson Coors and AB InBev have additional advice for c-stores to aid them in building category sales. Risk and Merlo both note the importance of cold beer for the channel. According to the Molson Coors executive, about 95% of all beer purchased in c-stores is cold, so refrigerated beer must be clearly priced and supported with regular promotional activity. Merlo added that proprietary AB InBev research on alcohol trip missions has found that beer singles align with the “pit-stop essential” mission, “a routine and auto-pilot trip where the shopper purchases items for short-term personal consumption.” Multipacks, meanwhile, fall into the “alcohol grab-and-go” trip, a less frequent trip but one where shoppers are purchasing products to share in a social setting. “Retailers looking to win this trip … need to prioritize ample cold space for the total beer category across doors and caves,” Merlo said.

Risk agrees that beer caves can provide a great value for c-stores. “Beer caves see high conversion rates from consumers who step through the doors,” he remarked, but low awareness of the cave and low comfort in visiting the cave can be challenges. He recommends “highly visible entrances and exits, clear lighting, and minimal signage in the beer cave door to help increase larger purchasing and consumer satisfaction.”

Meaningful Merchandising

Both Risk and Merlo also see value in merchandising beer outside of the traditional beer cooler and beer section of the store. Noting that c-stores see around 165 million transactions a day, the Molson Coors executive encourages operators to use ice bins and table-top coolers, and to merchandise beer near food to-go sections, where legal. “Shoppers in c-stores tend to make their trips quick, going straight for their product of choice and typically prioritizing the cold box,” said Merlo. “Ensuring that you retain these existing customers by executing category fundamentals should be the top priority. For stores that offer foodservice, place in-store activation near both the food and beverage categories to increase alcohol and food association and promote cross shopping.”

With effective merchandising, the proper brand and package selection for each individual store, and mindfulness toward keeping the shelves stocked, c-store operators can position themselves well in fighting back against languishing beer sales in 2025.

A Toast to Convenience

When it comes to liquor and wine, single-serve prepackaged cocktails remain all the rage in c-stores.

The liquor category joined beer in seeing a slight decline in sales in convenience stores last year, while wine appeared to buck the downward trend. The good news is that most of the excitement for the liquor and wine categories in c-stores these days is largely for emerging subcategories that are ideal for the convenience consumer.

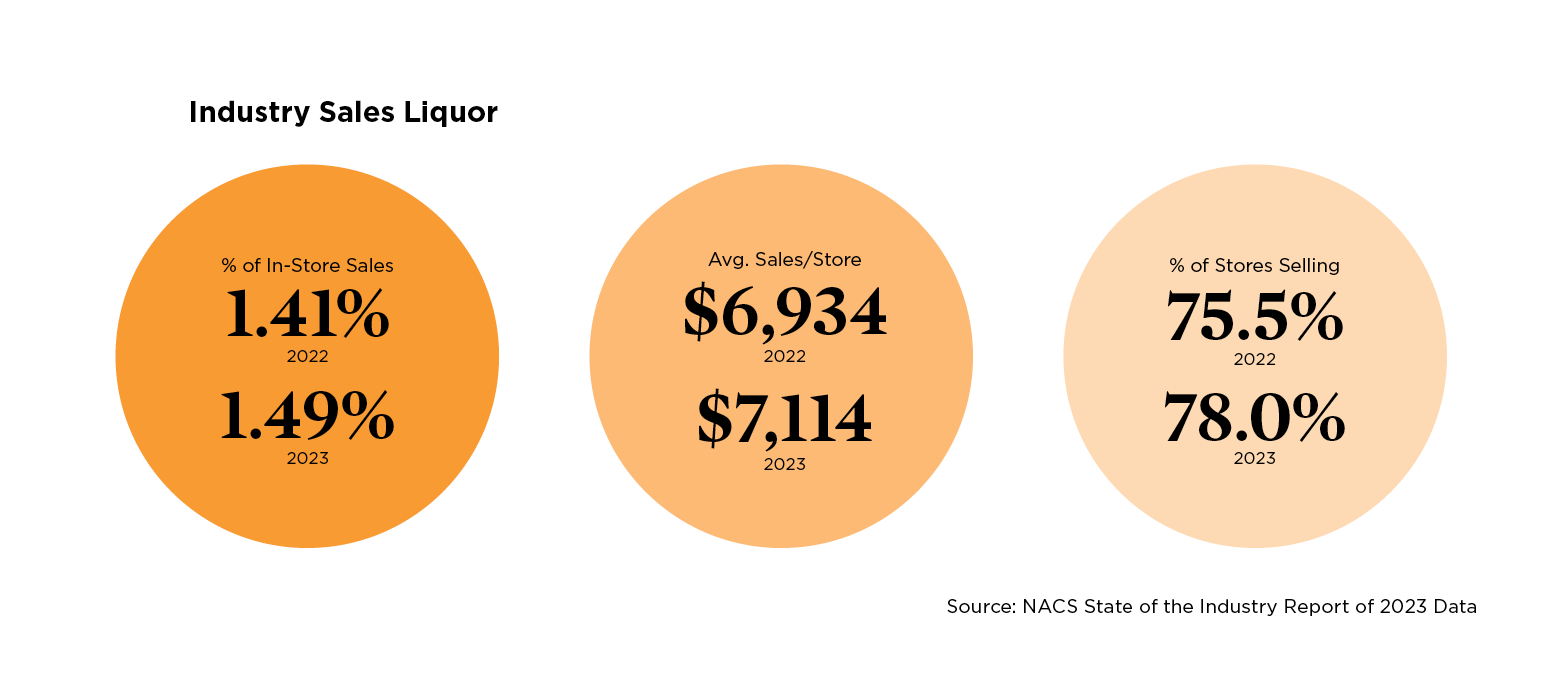

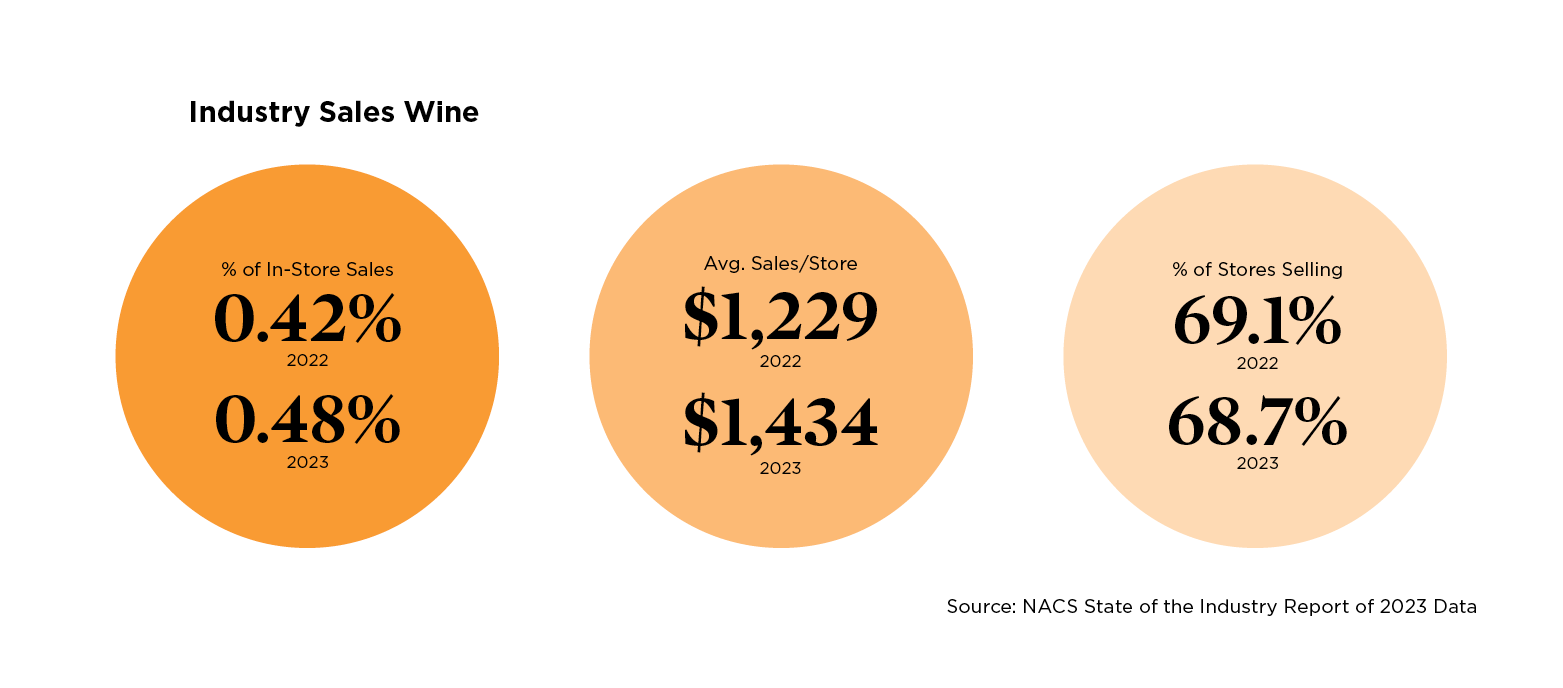

Average store sales per month for liquor increased nearly 3% in 2023 to $7,114, according to the NACS State of the Industry (SOI) Report® of 2023 Data. But for the nine months ended September 2024, CSX data shows average monthly sales largely lagged those of 2023. Average sales per month for wine, meanwhile, jumped almost 17% in 2023 to a still modest $1,434, and through the first three quarters of last year, category sales trends closely tracked those from the year prior, according to CSX.

Wine and liquor marketers, along with c-store operators, note that it’s products like prepared cocktails and wine coolers/wine cocktails that are performing best in the channel. Indeed, coolers/wine cocktails jumped ahead of table/varietal wine as the top subcategory in c-stores in 2023, according to the SOI Report. “Wine-based cocktails and coolers have been the craze for the last several years [as] emerging flavored wines have been entering the market and bring an interesting trend to the category,” said Laura Derba, senior vice president of retail operations at Global Partners LP. As such, alternative vessels, such as tetra paks, pouches and cups, have also been trending, the retailer noted.

Future Proof Brands’ Beatbox, packaged in 500 ml resealable tetra paks, nearly doubled its sales in c-stores last year, Phil Jamison, executive vice president, reported. “The convenience channel has been the No. 1 growth driver for us,” said Jamison, noting that Beatbox is sold at retailers that include 7-Eleven, Circle K and QuikTrip. He believes that products like Beatbox, which appeals to new legal-aged consumers, “can help expand the wine category for c-stores.”

Similarly, prepared spirits-based cocktails are proving a good fit for c-stores. “There’s no doubt RTDs are dominating sales, and there’s no sign their popularity will wane anytime soon” as consumers continue to be on the lookout for new flavors, remarked Herb Smith, vice president, customer development at Gallo, which is the marketer of the High Noon brand. Indeed, High Noon will soon launch a vodka-based hard tea variant, he noted.

Among other prepared cocktails, Surfside is gaining at a quick pace. Launched just a few years ago, the brand is now available at Wawa, 7-Eleven, Circle K, RaceTrac and Sheetz, among other retailers, said Clement Pappas, CEO at Stateside Brands. “Surfside lends itself to the c-store environment,” Pappas said. “It’s a ready-to-drink product in a can that fits the beer occasion.”

While prepared cocktails have commonly been available in multipacks, singles are quickly gaining share. “Complex cocktails can be highly incremental via singles,” said Greg Merlo, vice president, category leadership, at Anheuser-Busch InBev, which markets the Cutwater and Nutrl brands. Pappas added that just as c-stores promote two-fors on beer, similar deals are effective on canned cocktails. Pointing to the low-calorie, low-alcohol attributes of brands like Surfside that are typically priced at a 20-25% premium to beer, he said that with canned cocktails, “There’s opportunity for c-stores to increase sales and profit.”