There’s no shortage of tempting baked goods at convenience stores. “Consumers continue to seek convenient, affordable, indulgent snacks,” said Chris Balach, vice president of marketing, sweet baked snacks, for J.M. Smucker Co. “Hostess research with heavy users of convenience stores—young males—has shown they are looking for craveable, hearty, handheld sweet snacks.”

That interest keeps packaged sweet snacks in the top 10 merchandise categories at convenience stores. “The category snagged the final spot in 2023,” said Emma Tainter, NACS research analyst/writer. “While unit sales may need to be boosted, it’s a popular purchase for consumers.”

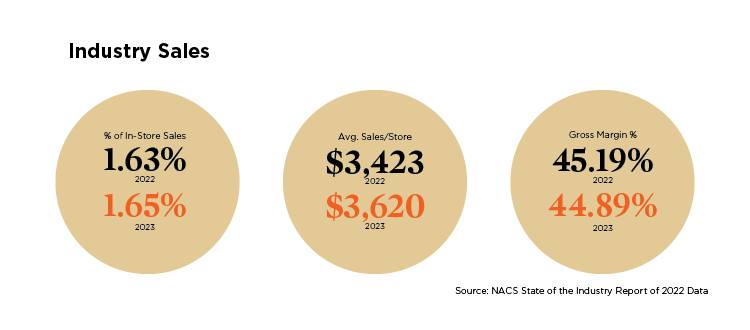

According to the NACS State of the Industry Report® of 2023 Data, packaged sweet snacks saw a year-over-year increase of 5.7% in sales, with 2023 sales coming in at $3,620 on average per store, per month. “Gross margin for the category dipped slightly from 45.19% in 2022 to 44.89% last year,” Tainter said. “However, gross profit per store, per month rose a bit to $1,625, up from $1,547 in 2022,” a year-over-year increase of 5.0%.

Individually wrapped cookies have become a staple in c-stores."

“While CSX data shows packaged sweet snacks sales steadily grew year-over-year, this might be an effect of inflation, rather than true growth,” cautioned Tainter. “When compared against NACS Research Merchandise CPI of 5.7% (meaning that a merchandise category only outpaced inflation if sales growth was higher than 5.7%) packaged sweet snacks barely realized true sales growth.”

“We’re seeing positive gains in packaged sweet snacks, but overall very marginal increases compared to last year,” said David M. Bogese, COO of the six-unit Breez-In stores headquartered in Prince George, Virginia.

“We believe the demand for packaged sweet snacks will continue to grow,” said Elizabeth Sommer, customer marketing manager for Rich Products. “Consumers are snacking throughout the day and are continually looking for grab-and-go items that are convenient while they are on the go.”

Sweet Trends

While consumers enjoy traditional packaged sweet snacks, innovative flavors and new products drive more category sales. Recent flavor trends include traditional Hispanic-style desserts as well as new spins on familiar brands coupled with baked goods, according to Rich Products. For example, Rich Products recently introduced a tres leches cake and a Funfetti cheesecake slice.

J.M. Smucker sees texture as the new flavor trend in sweet snacking, as well as mashups of favorite snacks. For example, Hostess Meltamors blends flavors and textures that are “inspired by warm restaurant desserts … with gooey melting centers,” Balach said.

“Consumers of packaged sweet snacks continue to show a willingness to try new and exciting flavors in familiar product forms,” said John Brown, senior vice president, snacking business unit, Flowers Bakeries. For example, the company launched lemon blueberry and chocolate in Tastykake Dipp’n Sticks and brown sugar cinnamon in Mrs. Freshley’s Donut Sticks. “Our brands will continue to innovate around key flavors like salted caramel, up-and-coming flavors like s’mores and emerging flavors like brown sugar.”

Individually wrapped cookies have become a staple in c-stores, including displays at coffee stations, beverage areas and checkout. “This is a simple way for c-stores to offer delicious cookies where consumers are picking up something to drink,” Sommer said.

Seasonal Sweets

Bringing in seasonal flavors in packaged sweet snacks can spark additional interest in the category as consumers often look forward to sampling different flavors as the calendar changes. “Consumers are extremely receptive to trying new seasonal flavors,” said Brown. “In the spring and summer, they tend to gravitate to lighter, fruit flavors and shift to warming, comforting flavors in the fall and winter.”

Rich Foods provides seasonal flavors to help spur impulse buys. “We offer some limited-time flavors in packaged sweet snacks, such as Our Specialty Treat Shop Lemon Sweet Middles cookies,” Sommer said.

Hostess also uses the calendar as a guide to limited-time flavors for its packaged sweet snacks. “Our seasonal program delivered more than $50 million in retail sales last year,” Balach said. “Seasonal and limited-edition flavors are a great opportunity for Hostess to test and learn more about innovative and on-trend flavors that could have a place in our line permanently, such as Pumpkin Spice Twinkies and Candy Cane Wafers” from the Voortman brand.

At Breez-In stores, seasonal and other limited-time offerings boost packaged sweet snack sales. “For example, we’ll sell a lot of banana nut and blueberry muffins in the summer and pumpkin spice muffins in the fall, as well as lemon cakes in the summer,” Bogese said. “Also, piña colada is a new flavor we’ve seen this year in baked goods that has been popular with customers.”

Sweet Challenges

The main challenge to packaged sweet snacks is “competition from prepared foods,” said Sommer. “Freshly made or freshly baked foodservice items are stealing some share from the packaged space. However, packaged sweet snacks still have a place in c-stores because consumers are looking for snacks that are convenient, high-protein and energy-boosting—and packaged sweet snacks can still meet those needs.”

Consumers of packaged sweet snacks continue to show a willingness to try new and exciting flavors in familiar product forms.”

Bogese has tapped into the fresh-baked trend at some locations. “At some of our stores, our fresh-baked, then packaged muffins and cookies are doing very well for us,” he said. “Customers enjoy the convenience of prepackaged items that are still very fresh.”

Because packaged sweet snacks is an impulse buy for most customers, where the category is in the store is key to its success. At Breez-In, Bogese studied the flow of customers through the store to determine where best to put packaged sweet snacks. “We wanted to make sure the customer passed through the section to get to the coffee station and energy drinks to further grab those impulse buys,” he said.

A Sweet Future

These suppliers and retailers see the future as strong for packaged sweet snacks in convenience stores because, as Brown puts it, “There is no better way for consumers to fill up on all their favorite snacks than stopping into their neighborhood convenience store.”

“True indulgence continues to outpace the other snacking segments, and baked goods are in the top five of the most frequently purchased snacks,” Balach pointed out. “Add to that trend that 91% of consumers seek quick and convenient solutions to meet their snacking needs, and convenience as a channel remains well positioned to meet consumer needs for sweet snacking.”

For Breez-In, packaged sweets snacks will remain a staple. “I think the future of packaged sweet snacks is pretty bright because of the variety and seasonal flavors of the products in an easy, grab-and-go format,” Bogese said.