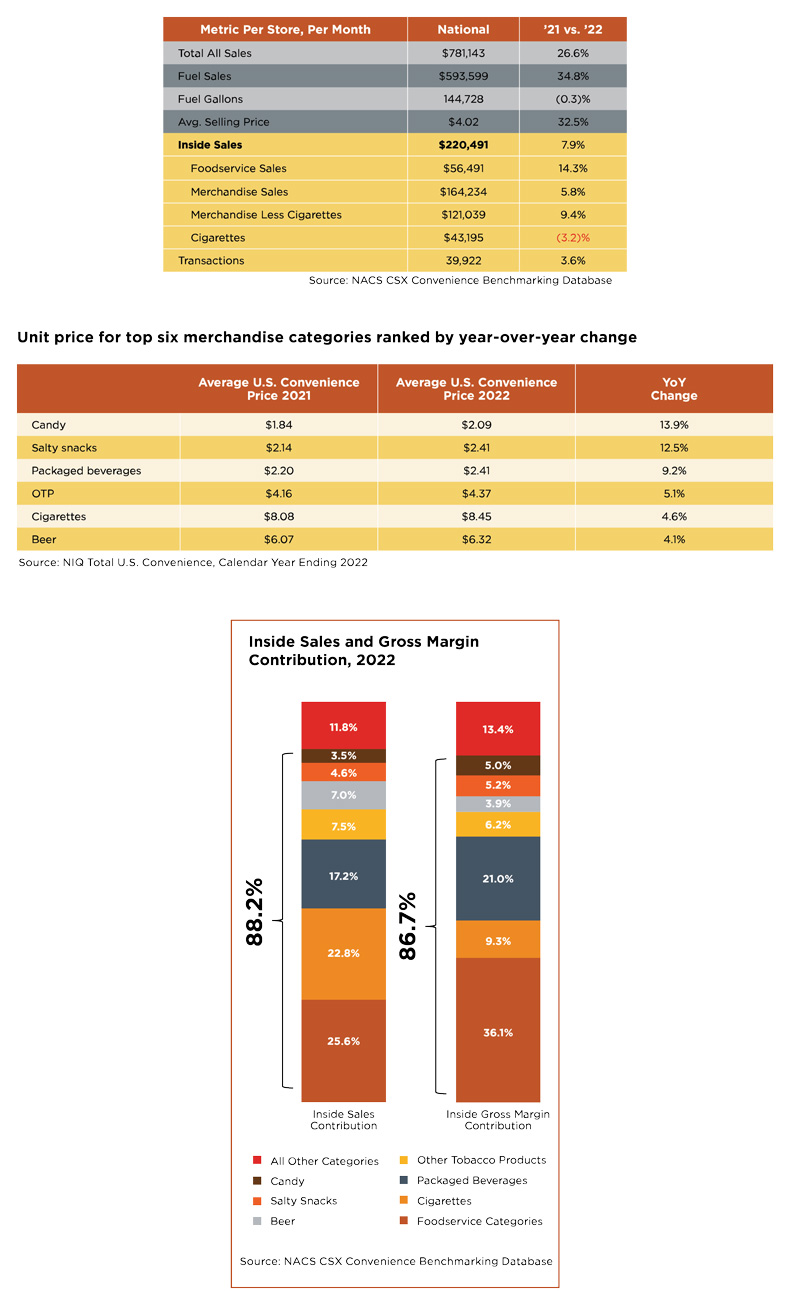

Amid pricing and inflationary pressures, U.S. convenience stores had record in-store sales of $302.9 billion in 2022, according to NACS State of the Industry data.

“No surprise but we continue to be a destination for food and drinks,” said Annie Gauthier, CFO/co-CEO of St. Romain Oil Company and Y-Not Stop, based in Mansura, Louisiana.

Gauthier shared newly released State of the Industry data that focused on the top six merchandise categories—cigarettes, packaged beverages, beer, OTP, salty snacks, candy—and the five foodservice categories of prepared food, commissary and hot, cold and frozen dispensed beverages, that make up nearly 90% of inside sales and gross margin.

Looking at the per store, per month sales for the top 10 merchandise categories, all but cigarettes and general merchandise had increased sales year over year, said Gauthier. Packaged beverages, OTP, salty snacks, candy and packaged sweet snacks all had double-digit sales growth year over year.

Packaged beverages, OTP, salty snacks, candy and packaged sweet snacks all had double-digit sales growth YoY.

Two categories saw sales drop. Cigarettes, which had experienced two years of sales growth, retracted in 2022. For general merchandise, the sales decrease could be caused by lower consumer demand for items like gloves, hand sanitizer and masks—items that were in high demand over the peak pandemic years.

When looking at the top 10 through the lens of gross profit contribution, cigarettes and packaged beverages trade the No. 1 and No. 2 spots since packaged beverages is a higher margin category.

Cigarettes

#1 Merchandise sales contributor;

#2 Merchandise margin contributor

15.14% gross margin

In 2022, convenience stores saw a -3.2% sales change year over year for cigarettes. “Unfortunately that negative sales change was also accompanied by a negative unit change of -7.5%,” said Gauthier.

For the cigarette subcategories (premium, subgeneric/private label, branded discount, fourth tier, imported), the main takeaway is that premium cigarettes account for roughly 76% of total category sales. Two subcategories had lower sales in December of 2022 than in January of 2019: branded discount and subgeneric/private label, while imported cigarettes has shown the most growth in recent years.

To summarize 2022 versus 2021 year-over-year sales and profit changes, there are a few factors that play into the category’s performance. For one, the U.S. smoking rate is down 30% from a rate of 21.2% in 2011 to 14.4% in 2021. Second is regulations and excise taxes, and flavor and menthol bans.

Packaged Beverages

#2 Merchandise sales contributor;

#1 Merchandise margin contributor

42.86% gross margin

The packaged beverages category had strong margins of about 43% in 2022, which led to higher profitability.

In 2021 and 2022, the industry experienced significant sales increases for packaged beverages on a consistent month-over-month basis, with 2022 coming in at 10.1% higher in sales than 2021. “The flip side of that is that unit sales were down about 1%. Our sales change was of course driven by the 9.1% average unit price increase that we saw in this category,” said Gauthier.

Most category sales and incremental growth came from two subcategories: carbonated soft drinks (8.8% YoY sales, 12.5% YoY gross profit) and energy drinks (12.3% YoY sales, 15.3% YoY gross profit).

Sports drinks had significant growth in 2022, delivering a whopping 20.7% sales increase and 23.8% gross profit increase. “We’ve got some interesting things going on with sports drinks as we continue to blur subcategory lines with companies that have traditionally been known for infant or child nutrition getting into the sports space, and companies known for sports drinks getting into the energy subcategory,” said Gauthier.

Not to be outdone, companies that have made their mark as energy drink companies are getting into coffee, and coffee companies are getting into the energy space. There’s also a big trend with influencers promoting products within the category, like the Prime energy drink promoted by YouTube stars Logan Paul and KSI.

“It’s getting increasingly challenging to classify these products—even more so if you’re a category manager trying to manage your resets and set your products in a logical flow so customers can find these new and innovative drinks,” Gauthier said.

“Overall, packaged beverages subcategories performed really well, with only juice drinks sales down year over year (-1.1%), although they managed to pull out a little more gross profit (1.0%) than the previous year,” she said.

Beer

#3 Merchandise sales contributor;

#6 Merchandise margin contributor

21.52% gross margin

“I don’t know about y’all, but I really like the sales trend for beer,” said Gauthier. Beer was on the uptick in April 2020 and remained that way into 2021 and 2022, delivering both a 4.9% positive sales change year over year as well as a mostly flat unit change.

The largest subcategory was premium beer, which is about a third of the overall category. Flavored malt, which includes hard seltzer, has seen a lot of innovation in recent years but “is flagging a little bit after several years of double-digit sales growth, making us wonder whether this category has reached its saturation,” said Gauthier, noting that the subcategory is about 7% of the overall category sales.

Non-alcoholic beer has almost doubled from 2020 to 2022, with some of the more established beer brands getting into this space. “We’ve also seen a completely non-alcoholic brewery open up and that’s Athletic Brewing Co.,” said Gauthier, noting that although NA beer is a small subcategory, “If you’re looking to be on the cutting edge in the beer category, this may be something you want to consider giving some space to.”

Imported beer has shown strong growth in the past few years, which is being driven by Mexican lagers. “That growth doesn’t show any indications of flagging at this point, so you may want to revisit how much space you’re giving to the import subcategory,” she said.

OTP

#4 Merchandise sales contributor;

#3 Merchandise margin contributor

28.90% gross margin

The OTP category has experienced incremental growth YoY for the past three years. There was a slight dip in 2020, but since then sales have continued to grow.

“This most recent year [2022] we had 10.0% year-over-year sales growth. And if we dive into the subcategories, we can see that it’s a category with two strong subcategories: smokeless, which is over 40% of the category, and e-cigarettes, which has grown to just under a third” of the category and shows no signs of leveling off, said Gauthier. “Those two subcategories alone make up about three quarters of the sales, and they’re both growing year over year.”

Two OTP subcategories are under indexed, meaning that sales are lower than they were four years ago: pipes and pipe/cigarette tobacco.

“What really stands out is the strong performance of the ‘other tobacco’ subcategory that was likely influenced by modern oral nicotine products,” said Gauthier, adding that NACS is revising the category definitions to include a dedicated subcategory for oral modern nicotine products. NIQ (formerly Nielsen) data shows that smokeless tobacco alternatives were up almost 50% year over year and comprised about 7.5% of total category sales.

And just like cigarettes, OTP is also challenged by regulations and excise taxes. “Most of the states on the West Coast and East Coast have adopted vapor excise taxes along with a smattering of states throughout the rest of the country—something to keep an eye on if you’re in one of the states that does not have a vapor excise tax,” she said.

Salty Snacks

#5 Merchandise sales contribution;

#5 Merchandise margin contribution

37.97% gross margin

“Salty snacks has a similar story to what we saw with packaged beverages. We see a dip in April 2020 compared to 2019, and then sales that ran relatively flat and then stronger in 2021, and strong growth in 2022 with a whopping 14.3% year-over-year sales growth, affected largely by the unit price increase of 12.5%,” said Gauthier.

There’s hot new flavors showing up—fortunately packaged beverages is commonly purchased with salty snacks.

The category did experience true unit growth at 2.8% year over year. “We dug in a little deeper to understand what was contributing to this, and what we found is producer price index (PPI) data from the U.S. Bureau of Labor Statistics that tracks the changes and sales prices for commodities producers over the past two years,” she said. The index cites price increases for key ingredients for snacking products like potatoes (up 96 points) and canola oil (up 26 points).

Monthly sales for the category show that the largest sales contributor to category sales was potato chips, followed by tortilla chips and other salty snacks, which contains items like puffed vegetables. “These three subcategories comprise over 70% of the category sales,” said Gauthier, noting that all nine subcategories trended the same with sales increases from 2019 to 2022.

“This category is a destination for healthy and flavorful better-for-you options. And then there’s hot new flavors showing up throughout this category—fortunately packaged beverages is one of the items most commonly purchased with salty snacks.”

Candy

#6 Merchandise sales contributor;

#4 Merchandise margin contributor

51.59% gross margin

Candy had the strongest gross margins of the top six merchandise categories at just under 52%. Like packaged beverages and salty snacks, candy’s four-year sales growth saw a dip in April 2020, followed by strong growth in 2021 and 2022 to deliver 15.1% year-over-year sales growth.

Like salty snacks, candy’s growth was driven by the average unit sales price. “Looking at PPI again, this time for sugar and corn sweeteners, both have seen significant growth over the past couple of years and have contributed to higher costs for confections,” said Gauthier.

Among the subcategories, chocolate bars/packs and peg candy were category leaders. “These two subcategories account for almost 60% of the total candy category,” she said, adding that one subcategory is also standing out: novelties/seasonal candy. “It’s grown at a faster pace than all the other candy subcategories, and we see spikes in February (Valentine’s Day), October (Halloween), and then the holidays in November and December.”

Gauthier shared that convenience retailers are doing a better job capturing and responding to the opportunities that exist in the candy space for seasonal sales. “If this isn’t a space where you’re playing, it’s low-hanging fruit that you could grab to grow your candy sales,” she said.

Candy trends to keep tabs on are chocolate premiumization, with a focus on indulgent and rich dark chocolates and specialty white chocolates, as well as “gummy everything” in the non-chocolate space.

“Every flavor, every animal, every plant—nothing is safe from being turned into a gummy and being turned into a sour or a non-sour gummy. These are flying off the shelves, especially among kids,” she said. Other trends include retro candies like wax bottles, candy buttons and Pop Rocks.

Foodservice delivers profitability

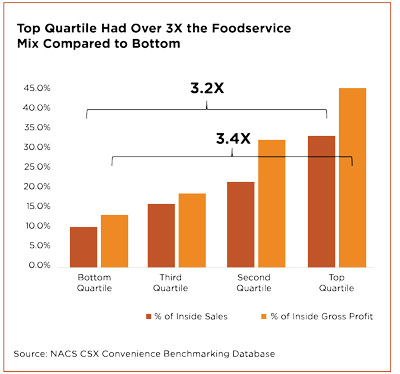

The high-margin foodservice categories represented 25.6% of inside sales and 36.1% of inside gross margin in 2022.

The high-margin foodservice categories represented 25.6% of inside sales and 36.1% of inside gross margin in 2022.

“We talk about foodservice differently than we talk about merchandise because it’s a different animal,” said Gauthier. “With merchandise, it’s about finding space, where to place the product and how to price it. Foodservice has those things and additional challenges, additional equipment, additional training, recipe development, etc. And of course food safety is a critical part of this component,” she said.

Building on the top performers conversation delivered during the operational and financial benchmarks session, Gauthier shared a huge distinction between the top and bottom quartiles.

Top quartile retailers typically generate more sales and significantly more gross profit from foodservice. Top performers averaged 31.5% of insides sales from foodservices categories, compared to only 9.6% for the bottom quartile. In terms of profitability, 42.4% of inside gross profit was generated from foodservice categories for top quartile retailers, compared to only 12.5% for the bottom.

“There’s a big opportunity here to drive profitability, and certainly a correlation between profitability and strength of your foodservice program relative to your merchandise sales,” she said.

Food inflation was up over 10% in 2022, with high spikes in ingredients like lettuce, eggs and meats. “It doesn’t look like we should expect these prices to go down anytime soon or stay down in a meaningful way, so that’s a challenge when it comes to maintaining strong margins in foodservice, as well as sourcing ingredients and keeping up with consumers, our suppliers and with pricing,” said Gauthier.

In terms of how foodservice sales would stack up among total inside sales, all but frozen dispensed beverages would make the top 10 in-store categories.

Prepared Food

As the largest piece of the foodservice pie, prepared food accounts for more than two-thirds of all foodservice sales at 67.3%. Prepared food would also be the No. 1 sales and gross profit contributor across all in-store categories with a gross margin of 55.35% and gross profit of $24,842 (per store, per month).

Among the other foodservice categories, commissary (9.5%), hot dispensed (9.2%) and cold dispensed (8.0%) all approached 10% of foodservice sales, with frozen dispensed rounding out the remaining 6.0%.

Commissary

The desire for prepackaged products allowed commissary to shine in 2020, and sales continued to increase in 2021. Commissary sales began to normalize in 2022 and represented 9.5% of foodservice sales. “After several years of growth in this category, it has started to level,” said Gauthier.

The largest sales contributor to commissary was sandwiches/wraps (42.1%) followed by meals ready to eat (29.0%), sides and salads (19.3%), and thaw, heat and eat (9.6%).

Hot, Cold, Frozen Dispensed

Representing 9.2% of foodservice sales is hot dispensed beverages. Coffee continues to be the largest subcategory within hot dispensed (72.2%), followed by cappuccino and specialty coffee (18.7%), hot chocolate (4.1%), refills (4.1%), coffee club mugs (0.8%) and hot tea (0.1%).

“Coffee is the No. 1 contributor, but the growth has been coming in specialty coffees and cappuccinos, with more and more retailers trying to compete against the coffee shops in their towns. There’s an opportunity here if that’s where you feel called,” said Gauthier.

Carbonated beverages continue to be over half of cold dispensed category sales at 52.2%, followed by other (43.0%), refills (4.2%) and non-carbonated (0.5%).

For frozen dispensed, non-carbonated makes up most of the category’s sales at 79.8%, followed by other (12.4%) and non-carbonated (7.8%). “All frozen dispensed subcategories experienced sales and gross profit increases year over year, leading the category to its strong numbers in 2022,” said Gauthier.

Wrapping Up the In-Store Business

Gauthier cited three areas to keep an eye on. First, foodservice is getting back to normal after several disruptive years, particularly within categories that were challenged during the pandemic.

Second, pricing will continue to play a major role in assessing sales growth. For categories that saw double-digit growth, how much was due to pricing changes? And third, there are two profit centers inside the store: foodservice and merchandise.

“I’d love to be able to wrap it all up and tell you which hot new items to put in your stores, but that’s not how it works,” Gauthier said, adding that it’s “up to each of us to consider what are our own challenges are. I encourage you to seize the data and choose your own c-store adventure.”