While the buying frenzy that drove impressive gains for beer sales at the height of the pandemic has abated, the category is still eking out growth in convenience stores. Retailers and marketers say that beer remains a key traffic and profit driver for the channel. With the right offerings and proper merchandising support, the category provides long-term opportunity for sustainable growth and store profit contributions.

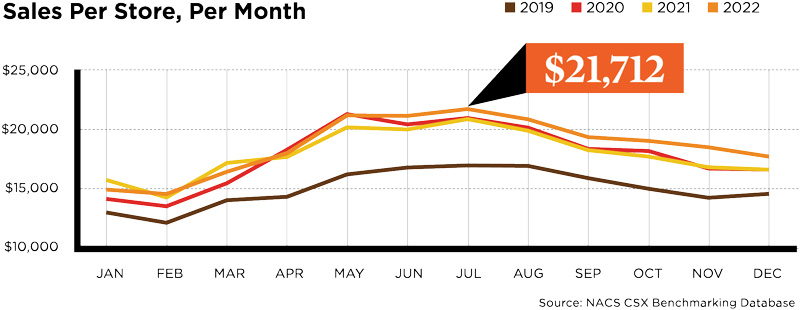

“Although growth for beer in 2022 may have been slight, it’s still positive news,” remarked Jayme Gough, NACS research manager. “Sales continue to hover around the 2020 mark, which was a big growth year for the category.” Indeed, according to monthly CSX data, sales for beer in the first half of 2022 mirrored sales in 2021, but from June to December, monthly sales increased, yielding a slight gain in category dollar sales for the year.

Inflation, however, has robbed beer unit sales of some of their momentum. “The increased cost of goods for all suppliers has impacted pricing throughout the three-tier system,” said Steve Gee, vice president of national accounts at Canarchy, parent company of craft breweries Oskar Blues and Cigar City. The average price of a case of beer is 8% higher than a year ago, he explained, and consumer pushback has kept volume relatively flat.

Greg Merlo, vice president of category leadership at Anheuser-Busch, added that the inflationary environment has prompted flat trips and units per trip for beer in c-stores, while spending is up. Due to the higher prices, the premiumization that has defined the beer category in recent years has slowed, resulting in some trade down to the value and mainstream segments, along with shifts to smaller packages, including singles. “This is a trend we expect to continue throughout 2023,” Merlo said.

Convenience retailers note that while inflation is making its mark on beer, shoppers have largely accepted the price hikes. “People expect it,” remarked Jason Grimm, category manager, packaged beverages at Wesco Inc. in Michigan. Year-to-date sales through March were flat on a volume basis but dollar sales were up at a mid-single-digit rate at Wesco. Similarly, at Cummings’ Market in Kennebunk, Maine, “Prices have crept up, but people are still buying,” reported manager Ben Blouin. He’s hoping that beer volume at the store finishes the year at least level with last year, with dollar sales higher. While the pace of rising inflation has slowed a bit, Gough said that if it rises again, consumers “could reach their breaking point and trade down.”

Import Surge

Beer subcategory trends were uneven in 2022. Sales of premiums, the largest subsegment, were flat, Gough said, while craft brews declined and imports surged. “Imports are driving the category,” she noted, with the subsegment showing particular growth late in the year. According to the NACS State of the Industry Report of 2022 Data, imports’ share of beer sales in the category increased from 13.4% to 14.7% in 2022. At Wesco, brews from Mexico—particularly Modelo Especial and Corona Extra—have been strong performers, helping to propel imported sales growth at a double-digit rate. As a result, Grimm has expanded points of distribution for Modelo, stocking single serves along with 6- and 12-packs. He’s also adding Modelo Oro, a new line extension.

While craft beer has been adversely impacted by inflation, as well as increased competition from other beverages, some c-store operators report strong performances for microbrews. “We sell a boatload of craft beer,” remarked Larry Tempesta, manager of Alpine Mart in Stowe, Vermont. “We still sell our share of Bud, Bud Light and PBR, but craft drives our business.” Out-of-town skiers who flock to Stowe are often in search of beers from renowned local breweries “and want to bring them back home with them,” he noted. Similarly, craft beer sales thrive at Horizon Fuel Center in San Diego, which is in close proximity to several brewery taprooms. President and CEO Hellyaachwehay Quisquis welcomes craft beers to his store. “We’re always open to exploring new products and we love the idea of providing a showcase for startup breweries,” he said.

We sell a boatload of craft beer.

At Wesco, meanwhile, dollar sales of craft brews are trending down, but unit sales are up, Grimm reported. “Customers are trading down in package size,” the retailer explained, often shifting from 6-packs to 19.2-ounce single cans. “Singles of New Belgium’s Voodoo Ranger are flying,” he noted.

Despite the current softness, craft brewers see opportunity ahead for their products in c-stores. “Craft is a $1.4 billion segment in convenience,” with an average case price of almost $45, Gee said. “That’s almost $15 higher than the beer category average.” Steve Wheeler, director of commercial strategy and execution at Michigan’s Founders Brewing, added that craft beer is still underdeveloped in c-stores versus other channels, with an underleveraged assortment. “In order to be viewed as a one-stop shop or beer destination, retailers need to carry a well-balanced portfolio,” he advised.

C-store operators would also be wise to monitor emerging beer subsegments. While still just a niche, non-alcoholic brews are showing the best growth at Wesco, Grimm said, and he’s considering expanding the selection. Indeed, non-alcoholic beers appeal to a widening consumer base increasingly looking to moderate their alcohol consumption, ranging from of-age Gen Z to baby boomer consumers. Cheladas—a traditional Mexican beverage comprised of lager, lime juice and spices—also show potential. “Cheladas showed a ton of growth although off of a small base,” last year, Gough remarked. With its close proximity to Mexico, Horizon Fuel is already benefitting from the trend, said Chris Phelps, the store’s general manager.

Lending Support

Sales of beer singles, the c-store channel’s workhorse, remain strong, retailers said. “Singles are growing both in units and dollars,” Grimm reported. Singles of premium domestic beers, such as Budweiser and Bud Light in 25-ounce cans, are the top performers at Wesco, he noted, adding that recent stocking issues have abated. He and Blouin pointed to the growing opportunity for craft singles in 19.2-ounce cans. “They’ve become very popular,” said the Maine retailer, “and now there are more and more entries.” The packages are typically priced at $2.99 to $3.79 each.

Cheladas—a traditional Mexican beverage comprised of lager, lime juice and spices—also show potential.

Savvy c-store operators know that to further drive sales of beer promotional and merchandising support are key. Blouin said he’s always on the lookout for the next hot product. “Everybody wants the new thing, so we’re constantly rotating our selection,” he explained. At Horizon Fuel, customers can create their own 6-pack of imported and craft brews. “Our customers are excited to find their next new favorite beer without the risk of purchasing a 6-pack,” Phelps said of the option. And at Wesco, members of the chain’s GoRewards loyalty program can now receive discounts on beer. Recent deals included $1.60 off the purchase of a case of premium beer. “Feedback from locations and customers has been positive,” Grimm remarked, adding that the inclusion of beer in the company’s loyalty offer is helping to drive new customers to the program.

Despite recent inflationary pressures, the prospects for beer in c-stores remain strong, suppliers said. “Beer is the No. 1 category in the cold box,” commented Anheuser-Busch’s Merlo, “and it’s critical to store health as it’s a destination category.” Canarchy’s Gee also points to category strength. “The beer category has always been an important source of growth in the convenience channel, and that won’t change in 2023,” he said. While consumer preferences may be shifting, Gee said, “the beer category will be positioned to meet those demands with a strong pipeline of innovative new products and a stable of important and valuable brands.”