The convenience factor of salty snacks is what makes them a c-store’s bread and butter, as if the category is baked into the store’s footprint, said Kelly Weiler, who owns Weiler Convenience Stores with her husband, Wayne. “People like to get in and out quickly while getting their favorite salty snacks.”

But they’re also looking to find innovative new flavors that bring novelty to this staple category.

“Customers have come to rely on salty snacks for its combination of tried-and-true classic snacks and consistent introduction of new and exciting flavors,” agreed Emma Tainter, NACS research analyst/writer. “In this category, it’s all about finding the perfect balance of core items and innovation.”

Salty Sales

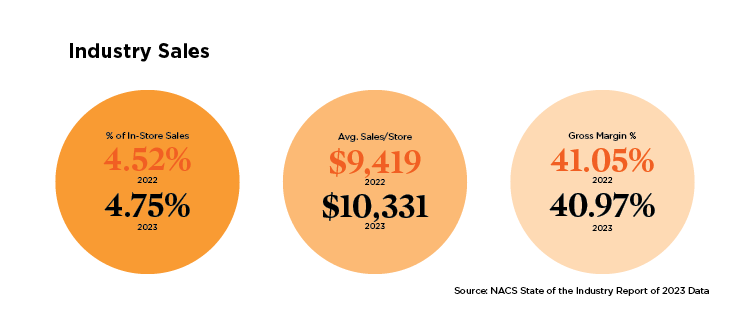

The salty snacks category has long been a reliable performer for convenience stores. According to the NACS State of the Industry Report® of 2023 Data, the category contributed 4.75% to total in-store sales last year and rose 9.7% in sales to reach $10,331 per store, per month on average. “This was higher than the NACS convenience CSX inflation metric, which means salty snacks experienced true growth as opposed to higher sales dollars due to inflation,” Tainter explained.

Gross profit dollars also jumped 9.5% in 2023 to hit $4,232, up from $3,867 in 2022. The majority of the category’s sales happen in the potato chips (32.9%), other salty snacks (28.4%) and tortilla/corn chips (12.5%) subcategories.

NACS CSX data also supports the healthy growth salty snacks is experiencing. The category peaked in May 2023 at $7,911 sales per store, per month, and started off 2024 strong—so far this year, monthly sales per store, per month have averaged $7,332.

“People like to get in and out quickly while getting their favorite salty snacks.”

“In general, salty snacks in convenience stores are doing well, driven by the expanding variety of flavor options that appeal to diverse consumer tastes,” said Diana Salsa, spokesperson for The Wonderful Company. “Additionally, the increasing trend of snacking replacing traditional meals bolsters the demand for convenient, ready-to-eat salty treats.”

Unique Snacks has also seen its salty snacks growing at convenience stores. “It’s been steady growth year-over-year since 2020,” said Norman Cross, vice president of brand, sales and marketing.

At Weiler Convenience Stores, with three locations in Marshfield, Wisconsin, salty snacks have been a mixed bag in terms of sales. “Some of the salty snacks category have been down, but the healthier salty snacks, like baked chips and popcorn, have been up,” said Weiler.

Salty snacks have been selling well at the Cusseta, Georgia, location of Gas N Go. “We’ve always sold a lot of salty snacks because we have a good number of travelers passing through our store,” said manager Shanna Lewis. Within the category, popcorn has been a top seller at Lewis’ store.

What’s Trending in Salty

The category’s embrace of the hot and spicy trend has helped with boosting sales. “Consumers are increasingly seeking bold, innovative flavors,” said Salsa. “America’s favorite snack brands are getting spicier as a result.”

“Spicy is doing very well for us because of the influence of our Spanish-speaking community,” Weiler said. “Everyone likes anything spicy in salty snacks.” Her stores stock the hot-flavored Takis, and buffalo and habanero versions of other chips.

Unique Snacks’ Cross added, “Whatever gives it more of a kick is selling strong at convenience stores. While the strongest trend tends to be spicy, adding indulgent flavors, like sweet with the salty, is also popular in the category.”

The demand for better-for-you salty snacks “continues to dictate the need for flavorful snacks that consumers can feel good about,” said Salsa. “Our strategy to encourage customers to choose healthier snack options over traditional chips has been effective, particularly by introducing flavors that echo popular chip varieties.”

Cross pointed out the growing number of salty snacks highlighting non-GMO, gluten-free and other tags they consider healthier on packaging, such as Unique Snacks’ new gluten-free, non-GMO Honey Mustard and Aged Cheddar Puffzels. “Consumers want to buy snacks that make them feel good and are tasty, so they are looking for these callouts,” he said.

Selling Salty

Knowing what other categories support salty snacks can bring in more sales, and merchandising salty snacks by the fresh foodservice and packaged beverages usually results in higher sales volume. “We give them a top spot by the coolers, which are near our deli at one location,” Weiler said. “Many times, customers will grab a sub and soda, along with a bag of chips.”

Whenever the store has new salty snacks, Weiler puts them on a separate display to draw more attention to the product. “We sell a lot more when I do that,” she said. One Weiler’s location recently dedicated an additional four feet to the category to accommodate more salty snacks. “We needed more space at that store because of the increased sales in the category,” she said.

“The increasing trend of snacking replacing traditional meals bolsters the demand for convenient, ready-to-eat salty treats.”

Salsa recommended using promotional signage provided by suppliers to draw even more attention to the category’s offerings. “By leveraging these merchandising strategies, retailers can maximize their salty snack sales effectively,” she said.

Retailers should also consider how customers are consuming salty snacks. For example, Weiler offers both single-serve and take-home sizes at all of its stores. “Many people like to pop in and grab the larger sizes because they don’t want to stop at a grocery store,” Weiler said.

Adding salty snacks to foodservice specials or promotions can boost sales as well. Gas N Go folds salty snacks into its regular promotions, including twofer and bundling with combo specials. “Those are popular with customers and do move salty snacks,” Lewis said.

A Salty Outlook

The future of salty snacks in convenience stores looks bright, with continued growth fueled by evolving consumer preferences, innovative product offerings and on-the-go sizes, according to The Wonderful Company’s Salsa. “Salty snacks are popular for their quick, satisfying appeal for on-the-go consumers seeking delicious and convenient snacks. The variety and accessibility of these snacks cater to diverse tastes and preferences, ensuring broad appeal,” she said.

“Our customers will continue to view convenience stores as the place to get salty snacks,” Lewis pointed out. “Our location along a highway brings in tourists who are looking for something salty, and our locals enjoy the quickness of a convenience store stop rather than getting their chips at a grocery store.”

Throwback: C-Stores and the 2017 Eclipse

In 2017, Rhoads drove down from Washington to the path of totality in Oregon. A word for his trek? Chaos. Rhoads noted he drove down to the site a couple of days before the actual event, and it was clear that he was one among many.

“At least 500,000 people came in to see the event, and these towns did a really good job of preparing, but you only have so much infrastructure for that number of cars,” he said. “One of the things we experienced on the drive was stop-and-go traffic for 20 miles.”

NACS Magazine covered the 2017 total solar eclipse after the event occurred.

“Everybody wanted the eclipse glasses, but we didn’t have any,” said Jean Milligan, deli manager at Reata Travel Stop in Sterling, Colorado. “Big mistake.” The travel stop did, however, stock up on various eclipse t-shirts, hoodies and souvenir items, which sold well.

At Milligan’s site, traffic exceeded expectations. “It was nonstop, but we didn’t run out of food,” she said.

On the big day, a Weigel’s store in Sweetwater, Tennessee, which was in the path of totality, threw an on-site eclipse party. The event included a spinner wheel, which let guests spin and win prizes, and samples of SharkEE, the chain’s frozen carbonated beverage.

“The kids made star bracelets and received coloring pages,” Drew Sparks, digital marketing coordinator at Weigel’s, said in 2017. “We passed out eclipse info sheets to the adults.”

Some retailers were happy to be part of the event even if they were not overwhelmed by traffic.

“We didn’t get near [as many] people in town as we expected to, but we had a great time,” said Chuck Allen, who managed a Twice Daily store in Cadiz, Tennessee, in 2017. The store hosted “Blackout in the Bluegrass,” a party for out-of-town guests and resident eclipse buffs.

Those in the zone of totality should expect a memorable experience.

“It was amazing to have it happen at our home,” said Natalie Bates, who experienced the event while working at Bodega convenience store in Jackson Hole, Wyoming. “The temperature dropped, and everything was dark. Dogs started barking, and babies started crying. It was kind of magical and cool.”