On September 29, coffee retailers across the country will celebrate National Coffee Day, honoring the ubiquitous caffeinated beverage that wakes up the world each morning. Tulsa, Oklahoma-based QuikTrip, and likely many other coffee retailers, will offer customers a free cup of java for the occasion.

“National Coffee Day, leading into fall, is a very popular coffee time of the year, with Pumpkin Spice being a popular choice everywhere,” said Aisha Jefferson, corporate communications manager for QuikTrip. “It’s a good time for customers to try out the seasonal LTOs as fall leads into winter.”

A lot of consumers love coffee, but hot dispensed beverage sales are mostly flat, according to the latest NACS State of the Industry Report® of 2023 Data. This is significant since hot dispensed beverages make up the industry’s second largest foodservice category after prepared food and made up 8.9% of foodservice sales in 2023, down from 9.1%.

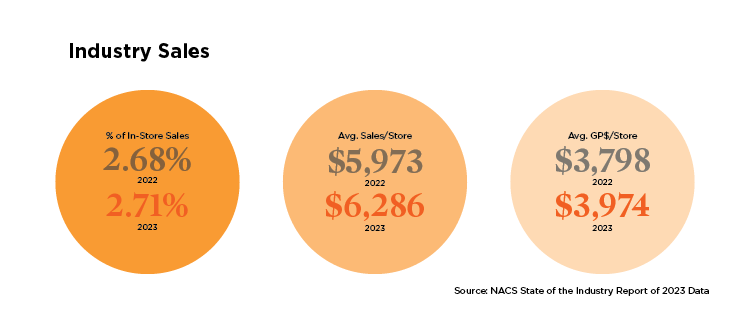

While the gross margin percentage decreased slightly from 63.59% to 63.22%, “sales increased from $5,973 to $6,286, and gross profits increased from $3,798 to $3,974,” said Emma Tainter, NACS research analyst/writer. “While this trends in the right direction, it wasn’t enough to beat inflation. NACS determined that only sales growth of over 8.9% was ‘true’ sales growth. Hot dispensed sales increased by only 5.2%.”

There are seven hot dispensed beverage subcategories: coffee, cappuccino and specialty coffee, refills, hot chocolate, other hot dispensed beverages, coffee club mugs and hot tea. Coffee obviously contributes the most to hot dispensed beverage sales (72.4% in 2023), but the cappuccino and specialty coffee subcategory is gaining traction.

“Cappuccino and specialty coffee sales increased from 18.0% to 18.2% of the category year over year,” Tainter said.

Changing Consumer Behaviors

Although there’s no way to confirm the origin of coffee, it’s believed that a 9th century goat herder in Yemen noticed that his goats were overly energetic after munching beans from a specific bush. He shared the beans with local monks, who then created a hot drink that has remained popular throughout the ages. However, ways to consume that drink have expanded and evolved.

“Today’s trend is cold beverages,” said Tim Cox, marketing manager for Franke Coffee Systems Americas. “Most coffee consumed is still hot, but cold drinks have seen tremendous growth since 2020, largely driven by younger millennial and Gen Z consumers. Cold coffee used to be a spring and summer drink, but now consumers enjoy cold coffee year-round.”

In addition, younger consumers are becoming coffee drinkers at an earlier age.

“Gen Z customers started drinking coffee at the youngest age of all generations—as young as 14 years old, according to Statista,” said Drew Whitefield, senior category manager of hot and cold coffee for 7-Eleven. “Cold coffee—both cold brew and iced specialty—is the most popular when it comes to young consumers.”

In fact, about 75% of cold coffee buyers are under the age of 35, according to Chairil McClain, vice president for market strategy at BUNN, the beverage equipment manufacturer. “Throughout the foodservice industry, leaders are focusing on the cold coffee segment,” she said. “They see much opportunity for growth in this area.”

Factors other than youthful trendsetting have impacted coffee consumption. Art Lopez, vice president of marketing for Finlays, a global coffee supplier, believes cold coffee’s growing popularity is partly due to the quintessential American time crunch.

“A hot beverage tends to be enjoyed over time, time which Americans don’t have these days,” he said. “Coffee shop culture is to sit down, relax and enjoy your hot drink. But there’s no such thing as a 15-minute coffee break anymore. In the United States, we’ve gotten more go, go, go than ever before. Cold beverages lend themselves to quick consumption and quick energy.”

Consumers spend an average of $301 million on coffee and related goods every day.”

Plus, long established consumer work schedules and coffee-drinking habits changed during the pandemic, said Jennie Jones, senior vice president of convenience and retail at SEB Professional, a California-based coffee solutions company.

“The convenience industry’s traditional dayparts have been disrupted,” she said. “For years, the morning daypart was top of mind. Now, dayparts merge together, and that’s impactful. But retailers can gain additional sales if they pay attention to the entire day.”

Research confirms that. The National Coffee Association (NCA) reports that while 81% of U.S. coffee consumers enjoy coffee with breakfast and 38% sip “in the morning,” others drink coffee with lunch (15%), in the afternoon (19%), with dinner (7%) and in the evening (10%).

Despite cravings for cold, hot coffee remains vital. “Quality, flavor variety and energizing hot dispensed beverages are always in demand,” said Donna Hood Crecca, a principal at Technomic. “But today’s consumer also wants new, unique options. Hot specialty coffees with unexpected flavors, such as TXB’s Southern Pecan, or higher caffeine levels, like Cliff’s Local Markets’ Wake the Hell Up blend, are very much on trend.”

Specialty Coffee Picks Up Steam

Specialty coffee starts with premium beans that score 80 or more on a 100-point scale as determined by professional bean raters, known as Q Graders. Coffee drinkers may know zilch about Q Graders, but they recognize quality when they taste it. According to a recent report jointly produced by the NCA and the Specialty Coffee Association, 45% of Americans say they’ve consumed some form of specialty coffee within the past day.

“That’s the highest past-day specialty coffee consumption level since 2011, up by 80% since then,” said Bruce Goldsmith, president of Baronet Coffee of Windsor, Connecticut, and an NCA board member.

In addition, “44% of Americans have had an espresso-based beverage in the past week, up by almost 20% since 2020,” he said. “Lattes are the most popular espresso-based beverage, enjoyed by 18% of American adults in the past week and followed by espresso (16%) and cappuccinos (14%).”

“Those drinks are harder to execute at home, so offering them can be a great way for retailers to entice customers away from home for their coffee purchases,” McClain added.

Customization and Variety

Coffee customers crave variety. That’s why 7-Eleven recently introduced its first-ever flavored cold brews, all made from 100% Arabica cold brew extract, real cold brew, whole milk and cane sugar. “It’s all about variety, something new to try as a reward or whenever you’re feeling adventurous,” Whitefield said of the expanded selection, which includes flavors like Mocha and Caramel Cream.

In January, Oregon-based Dutch Bros Coffee rolled out an LTO protein coffee. Customers loved it, and it’s now a permanent offering. Sometimes dubbed “proffee,” protein coffee combines coffee or espresso with protein powder or a pre-made protein shake. It’s served cold since protein products and hot coffee don’t blend well. Advocates claim it suppresses appetite and boosts metabolism.

Anthony Lynch, senior vice president of c-store sales for Westrock, a beverage solutions provider based in Arkansas, said the company’s data points to customers “looking for origin differences, roast profile ranges and different levels of caffeine. With a range of geographical resources, we can offer different blends and different flavored coffee options, and we can create coffee offerings with additional caffeine to capture the energy consumer who is seeking a pick-me-up they can customize themselves via the condiment bar.”

And that customization is critical. Many c-store beverage bars feature basic “add-ons,” including sweeteners, syrups, flavors and creamers, but traditional items may not satisfy young shoppers who increasingly want plant-based milks, natural sweeteners like maple syrup or honey, and spices, such as cinnamon and cardamom.

“Natural sweeteners and plant-based creamers are often difficult to get in portion-controlled cups,” noted Lynch.

Because variety drives coffee sales, a well-appointed beverage bar can be the deciding factor among the competition.

“Over three-quarters of drinkers prefer their coffee flavored in some way—whether opting for flavored beans or adding flavors via syrups, creamers, sweeteners or toppings,” Cox said. “Providing a variety of additives is a great way to ensure every customer gets their coffee exactly how they like it.”

Upgrade to Entice Shoppers

Hot tea and chocolate sales can’t compete with that of coffee, but both have growth potential.

NIQ reports that functional beverage sales jumped 54% to $9.2 billion between March 2020 and March 2024 as shoppers seek healthier drinks that provide hydration. “Tea has that halo effect of that functional, healthier beverage,” McClain said. “There are opportunities [in foodservice] for growth with chai latte and matcha, but I haven’t seen c-stores offering those two.”

For a more indulgent hot drink, “Mexican hot chocolate is delicious and has a hint of spiciness,” she said. “Consumers can dress it up with hot foam, whipped cream or cookie crumbles to make a textured drink and enjoy a more elevated experience.”

People will always drink hot coffee, “but when it comes to growth, it’s going to be cold,” said Lopez. “Americans need energy now more than ever, and beverages will always be a place to solve that problem for people. At the end of the day, most people choose coffee, tea or whatever else because they need a pick-me-up.”

“There’s no such thing as a 15-minute coffee break anymore.”

Retailers interested in boosting their beverage bar business should work with their roaster partner to set up a plan for growth. “C-store operators may want to experiment with flavors, specialty coffees and even espresso-based beverages, hot and cold,” Goldsmith said.

And as always, quality and value remain beverage bar priorities.

“Retailers that convey quality cues—freshness, roasts, brand and preparation—will ramp up the quality perception,” said Crecca. “That allows them to price hot coffee at a point that is competitive with coffee shops, yet still delivers margin.”

According to NCA’s 2023 economic impact study, coffee accounts for 8% of the total value of the U.S. foodservice sector, said Goldsmith. “Consumers spend an average of $301 million on coffee and related goods every day—that’s $110 billion per year, and $7.4 billion of that is spent in c-stores. Although we can’t predict the future, it’s safe to say that America’s love affair with coffee will continue for generations to come.”